The last few years have presented no shortage of challenges for the seniors housing and healthcare industry. Following a global pandemic, staffing shortages, and multiple bouts of market volatility, many are no doubt ready for a new chapter to unfold. Will 2025 be a year of substantial growth and success for seniors housing and healthcare communities?

In this article, we examine recent market data to provide reasons for optimism (i.e., continued occupancy gains and improving fundamentals), the lingering challenges (i.e., rising expenses and economic uncertainty), and the emerging opportunities for growth and laying the foundation for long-term prosperity.

Occupancy Climbs

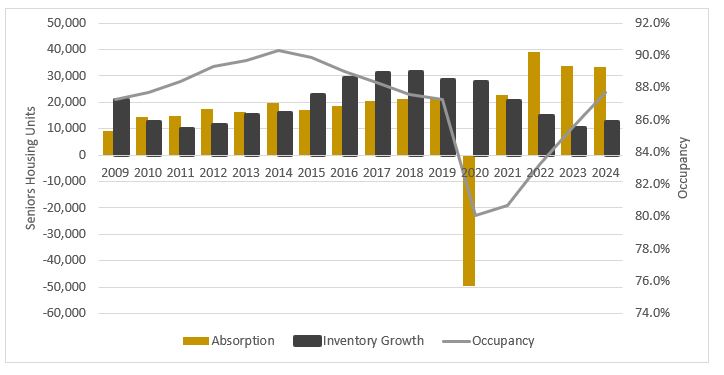

The seniors housing sector continued its run of occupancy gains in 2024. According to NIC MAP Vision, the occupancy rate within primary and secondary markets rose from 85.6% at the end of 2023 to 87.7% in 4Q24 (Figure 1). After declining by 720 basis points (bps) in 2020, the seniors housing occupancy rate has risen by over 200 bps in each of the past three years and now sits above the pre-pandemic level of 87.3%. Absorption levels were near cyclical highs at over 33,000 units in 2024. Although the absorption level is lower than levels established in 2022 and 2023, it is far outpacing inventory growth of just over 12,500 units in 2024.

Industry participants also reported occupancy increases in 2024. Sonida Senior Living reported its occupancy rate across 61 same-store communities rose from 84.9% in 3Q23 to 87.0% in 3Q24. Brookdale Senior Living reported its consolidated occupancy for December 2024 was 79.3% and increased 100 bps since December 2023. Publicly listed healthcare real estate investment trusts (REITs) also reported occupancy gains in 2024. Welltower reported its 3Q24 occupancy was 85.9% (up from 82.8% in 3Q23) across its same store seniors housing operating portfolio (SHOP). Ventas REIT reported 3Q24 same store SHOP occupancy of 87.0%, up from 83.5% in 3Q23.

Occupancy gains across the seniors housing sector were achieved in the face of rising expenses. Welltower reported total expense growth of 4.6% across its same store SHOP portfolio, including compensation expense growth of 5.1%. Ventas reported operating expense growth of 6.0% in 3Q24.

As 2025 unfolds, we expect continued growth in top line operating metrics. Underlying supply and demand fundamentals continue to remain favorable and should buoy occupancy rates throughout the year.

Skilled Nursing Occupancy Rates Rising

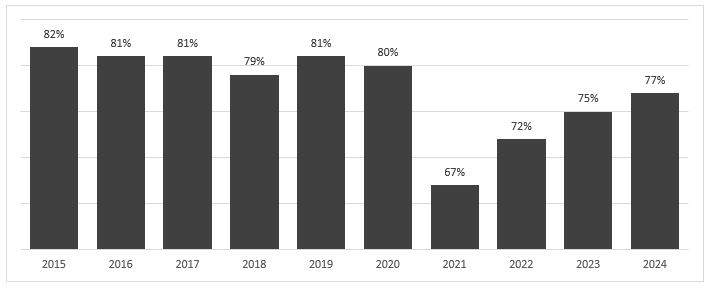

Likewise, occupancy rates for skilled nursing facilities (SNFs) continued to rise in 2024. The certified skilled nursing occupancy rate across the United States rose to 77% in July of 2023 compared to 75% one year earlier, according to a Kaiser Foundation analysis (Figure 2). Skilled nursing occupancy rates are clearly in recovery after establishing a cyclical low of 67% in 2021.

The Ensign Group reported its same facility occupancy rate in 3Q24 was 81.7% across 193 same store properties, up from 79.5% one year earlier. In addition, Ensign reported same facility skilled services revenue was up 7.3% in 3Q23. Omega Healthcare Investors said occupancy across its portfolio rose from 78.6% in June of 2023 to 80.9% in June of 2024. Omega Health’s strong results across its large diverse portfolio of 962 skilled nursing and seniors housing and care communities provide further evidence of improving operating fundamentals across the industry.

The reimbursement outlook for the skilled nursing sector in 2025 is favorable. The Centers for Medicare and Medicaid Services (CMS) issued a final rule which resulted in a 4.2% net increase for Medicare Part A payments to SNFs in 2025.

Will the Transactions Market Begin to Recover in 2025?

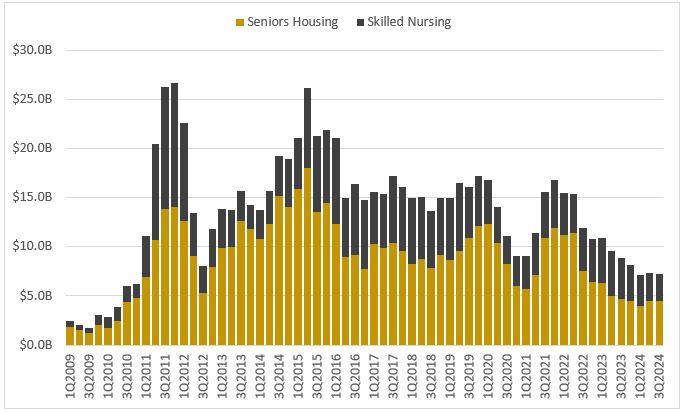

A challenging capital markets environment festered throughout 2024, as investment volumes remain muted. According to NIC MAP Vision, seniors housing and skilled nursing property annual transaction volume totaled $7.2 billion in 3Q24 (Figure 3). Transaction volume was relatively flat sequentially but down 19% from 3Q23.

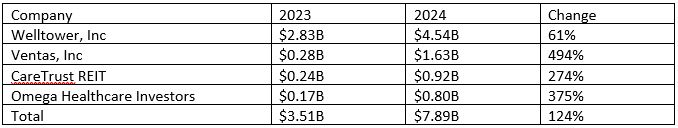

The largest healthcare REITs in the seniors housing and skilled nursing sector generally picked up their investment activity in 2024. Welltower, Ventas, Caretrust REIT and Omega Healthcare Investors have collectively deployed $7.89 billion (Figure 4) of investment capital in 2024 (through 3Q24). That is up significantly from the same period in 2023 when the group had year-to-date (YTD) investment activity of $3.51 billion. This investment activity reflects gross activity across each REIT including other healthcare property types, acquisitions, mortgage financings, and development funding. The REITS also provide a glimpse into pricing trends. In 2023 initial yields were 7.6% across these investors while in 2024 initial yields have averaged 8.2%.

(source: Company Quarterly Reports)

The lending environment for developers and owners was a mixed bag in 2024. Some capital sources increased lending activities while others paused or pulled back. The U.S. Department of Housing and Urban Development/Federal Housing Administration (HUD/FHA) Sec. 232 program reported fiscal year (FY) 2024 loan commitments of $4.1 billion across 263 loans, up 42% from $2.9 billion across 186 loans in FY 2023. Fannie Mae reported in 3Q24 that its overall loan count on seniors housing properties was 517, down 10% from 3Q23 when Fannie reported loans on 576 seniors housing properties.

Values on many properties have struggled to rise or have even declined due to rising interest rates and capitalization rates. As a result, lenders with debt across commercial real estate are often extending or renegotiating terms rather than forcing a refinance or exit. However, extensions are only a temporary fix, and finding a beneficial long-term financing solution should be a priority for many owners in the coming months. Loan maturities will be a key item to monitor into 2025.

The overall outlook, from the optimist’s perspective, is that we are past the interest rate uncertainty that has stalled growth plans. As 2025 progresses, there is a general sentiment that rates will normalize in the near term—at higher levels than recent years, but still low by historical standards. As such, the stage is set for a gradual, steady, and accelerating recovery in transaction activity for 2025 and beyond.

This report was co-authored by Mike Hargrave, principal at Revista. He may be reached at mike@revistamed.com.