The U.S. Department of Housing and Urban Development (HUD) has issued two memos that could lead to increased loan proceeds for multifamily and affordable housing borrowers. The memos, which are still in draft form and open for comment, can potentially increase loan proceeds for borrowers up to 6%.

Market-Rate and Affordable Housing

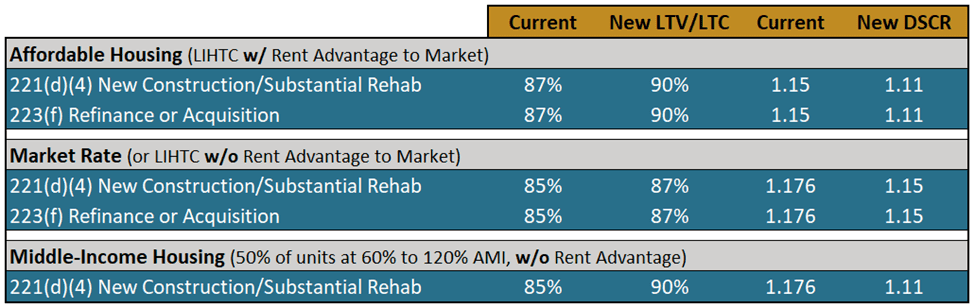

Specifically, the first memo adjusts the loan-to-value/loan-to-cost (LTV/LTC) and debt service coverage ratio (DSCR) for the development, rehabilitation, acquisition or refinancing of market-rate housing (or LIHTC housing without rent advantage) from 85%/1.176x to 87%/1.15x. Affordable housing (LIHTC with rent advantage to market) also sees a boost in proceeds thanks to a shift from 87%/1.15x to 90%/1.11x.

Middle-Income Housing

The second memo calls for similar adjustments to middle-income housing, which HUD generally defines as affordable to households earning between 60% to 120% of AMI, and up to 150% AMI in some high-cost areas. The LTC and DSCR for the development and rehabilitation of middle-income housing shift from 85%/1.176x to 90%/1.11x.

The proposed adjustments are detailed in the table below.

In addition to future transactions, any loan currently under application that has not closed can benefit from the improved loan parameters, should they go into effect. The public comment period closes on November 25, 2024, and the new rules are expected to go into effect by mid-December of this year.

For more information on how to leverage these changes for your growth plans, contact one of our FHA experts today.