If you asked anyone what the future held for multifamily at the end of 2023, you might have heard some grim predictions. A record number of new apartment units were set to hit the market. Fundamentals were stagnating or slipping, and operational costs were on the rise. And with few people willing to get off the sidelines, transactions had slowed to a crawl.

But here we are in late 2024, and I’m happy to report that multifamily has once again proved its resiliency. This is not just wishful thinking. There’s tangible evidence (see our Fall 2024 Multifamily Overview) that multifamily market fundamentals are stabilizing and even strengthening. Investors are taking notice, the gap between buyer and seller expectations is narrowing, and transactions are picking up steam.

Peak Deliveries Are Now Behind Us

Much of this confidence comes from reaching a critical milestone: new construction deliveries have peaked. The 147,000 units completed in Q3 2024 were the high-water mark. Looking ahead, Yardi Matrix shows deliveries steadily moderating, with quarterly averages of 127,000 units in 2025 and 93,000 in 2026.

At the same time, demand has remained steady, primarily because home ownership has become increasingly out of reach for many. Home prices have shot up and, even after the Fed cut interest rates, mortgages are still high. Fewer than 35% of U.S. households can afford monthly payments on a median-priced home, even if they could raise a downpayment. Given this level of demand, new supply should be soaked up quickly.

Fundamentals Have Turned Around

This supply/demand rebalancing bodes very well for multifamily. This is true even for Class A properties, which saw the vast majority of the new supply. Vacancy has already fallen to 5.3% in Q3 2024 from its high of 5.5% earlier this year. While Class A rent growth remains flat year-over-year, we have at least exited the negative territory as of Q4 2023. Class B and C properties, which were relatively insulated from the impact of new supply, are a step ahead. Vacancies in both classes peaked in early 2024, and they achieved solid positive year-over-year rent growth of 1.1% and 2.6%, respectively.

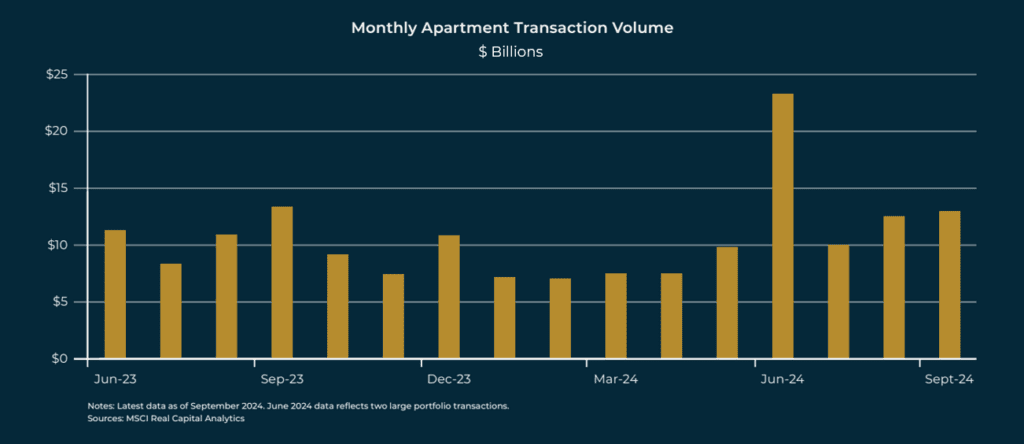

Transaction Activity is Back

Given reviving fundamentals, it just makes sense that the third quarter also marked a turning point for multifamily investment activity. Transaction volume hit $35.8 billion in Q3 2024—a 9% increase compared to Q3 2023 and the second consecutive quarter of year-over-year growth. August and September were especially strong, with monthly transaction volumes exceeding the first half of the year by more than 20%. In fact, after removing June data (which included Blackstone’s and KKR’s massive portfolio acquisitions), September sales volume was the highest in a year.

Even more notable is the price-per-unit increase. In Q3, the average price per unit rose to more than $217,000, up from less than $200,000 earlier this year. This rise highlights renewed interest in high-quality apartment assets with strong demand drivers and operating performance.

A Brighter Future

With a more manageable number of deliveries on the horizon and market fundamentals moving into positive territory, we have entered the kind of stable market that is familiar to most investors. This greater certainty has led to the bid-ask spread narrowing and encouraged investors to reenter the market.

Last year, caution dictated that investors sit on the sidelines. Now with the market turning around, experience suggests that this is the ideal time to get back in.

Want to dive deeper into the data and trends shaping this recovery? Access Lument’s Fall 2024 National Multifamily Overview.