As I wrap up my busiest conference season of the year, I thought the time was right to share my thoughts on some of the chatter I’ve picked up on the road. My first stop was Las Vegas for the 2025 NMHC Annual Meeting, which saw a record-breaking attendance. A week later, I headed to my first MBA CREF in San Diego for a crash course on all things debt-related. Last week, I had the pleasure of joining some of the top apartment owners in Vail at the Multifamily Executive Leadership Summit. Life is rough.

Signs of Life

If I had to sum up overall sentiments in one phrase, I think “cautious optimism with a heavy dose of uncertainty” about does it. It was great seeing live deals being worked on at NMHC again, as participants are clearly ready to get off the sidelines. The data shows they have started to do so. Multifamily investment sales increased to $146 billion in 2024, a 22% increase over the year priori. While deals are getting done, there is room for continued recovery. Sales volume still trailed the five-year annual average between 2015 and 2019 (what I think of as the last stretch of ‘normalcy’) by 14%, though I expect we will be back near that volume level within the next couple of years. Valuations appear to be stable and NOI’s are projected to rise in coming years, which could improve initial returns on acquisitions.

(For a deeper dive into transaction volume, market fundamentals, and debt trends, read Lument’s Q1 2025 National Multifamily Market Report here.)

A Bifurcated Market

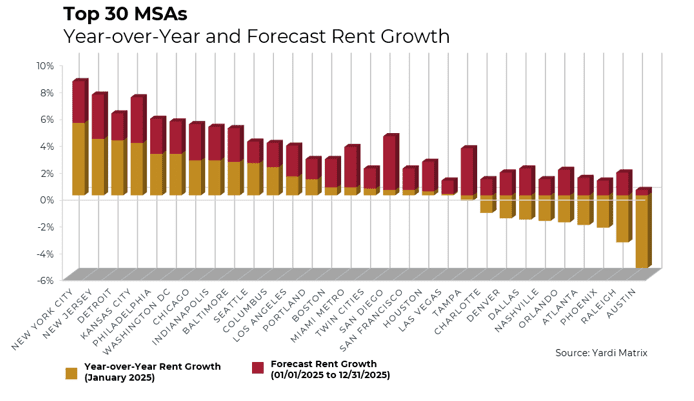

I had the pleasure of moderating a panel on multifamily development strategy at NMHC, and the takeaways from selecting a market to build in also apply to evaluating investment opportunities. Though peak delivery hit in late 2024, there is still a lot of supply to run through, especially in the Sunbelt markets. Certain Midwestern and Coastal markets are lagging and poised for greater near-term rent growth. And within markets in general, it was interesting to hear that recent development largely focused on inner and outer suburbs. There is more room to run in the urban core — a fact that may present additional opportunities as the return-to-office trend continues to take hold. The bifurcation between markets comes through in the graph below, which displays annual and forecasted rent growth.

It is only natural for improving fundamentals and transaction volume to yield more lending. Multifamily lending increased from $246 billion in 2023 to $312 billion in 2024, a 27% increaseii. Much of this activity manifested in Q4 2024. Looking at volumes coming out of our agency partners Fannie Mae and Freddie Mac, we saw Q4 volume nearly double this year compared to last ($52.6 billion versus $27.1 billion). Some of this activity was driven by rate locks taking advantage of the dip in the 10-year Treasury between August and October (many of our borrowers are taking advantage of the current 10-year rally to do the same). The wall of maturities — which, according to chatter from MBA, have pushed “extend and pretend” to the limit — is another factor driving the increase in debt volume.

We also heard that debt structures and strategies are shifting. Five-year, fixed-rate loans were the fashion du jour for much of 2024. We are now seeing borrower movement towards floating-rate products featuring more favorable prepayment terms (for example, floating-rate Freddie Mac loans feature a lockout in year one followed by 1% thereafter). Another trend is that with acquisition activity ramping up, so has the appetite for equity. I expect that equity placement will remain a strong variable in boosting deal volume this year, especially as capital sources are starting to broaden their purview past distressed assets.

More than a Few Shakes of Uncertainty

Closing out my tour in Vail, I had the unique opportunity for uninterrupted access to some of the top minds in multifamily (a chair lift will do that). There were some common threads that came out of these conversations: yes, the multifamily industry is showing signs of momentum as investment activity picks up and fundamentals strengthen. At the same time, the industry is keeping a very close eye on Washington.

We’ve seen an unprecedented pace of activity in the first few weeks of the new administration, with over 70 executive orders signed in the past month and a half — far outpacing the 33 orders from Trump’s first 100 days in office during his first term. With wide-ranging proposed policy changes and new leadership appointments, multifamily investors are faced with a delicate balancing act of bracing for potential shifts while trying to take advantage of the current opportunities presented in the market. For now, the best strategy seems to be staying informed, staying nimble, and keeping an eye on both the deal flow and the policy landscape.

iMSCI Real Capital Analytics

iiMortgage Bankers Association