The U.S. Department of Housing and Urban Development (HUD)/Federal Housing Administration (FHA) has officially implemented a series of programmatic changes designed to increase loan proceeds for multifamily and affordable housing borrowers.

First announced in November 2024, these updates come from two mortgagee letters: one which adjusts market-rate and affordable housing debt service coverage ratios (DSCR) and loan to value/loan to cost ratios (LTV/LTVC), and a second that creates a new set of underwriting thresholds for middle-income housing. The changes went into effect on January 8, 2025, mostly as proposed, and can potentially increase loan proceeds for borrowers by up to 6%.

“These updates reflect HUD’s steadfast commitment to fostering rental housing affordability across all income levels,” said Paul Weissman, senior managing director and head of affordable housing at Lument. “We look forward to leveraging these changes to help clients create and preserve housing that serves our communities more effectively.”

Market-Rate and Affordable Housing

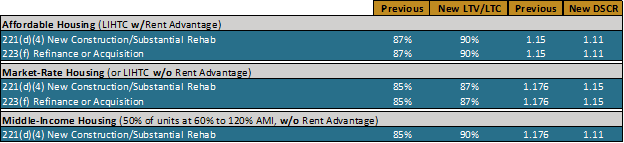

Mortgagee Letter 2025-03 adjusts the loan-to-value/loan-to-cost (LTV/LTC) ratios and debt service coverage ratio (DSCR) for the development, rehabilitation, acquisition, or refinancing of market-rate housing (or LIHTC housing without rent advantage[1]) from 85%/1.176x to 87%/1.15x. Affordable housing (LIHTC with rent advantage) also sees a boost in proceeds thanks to a shift from 87%/1.15x to 90%/1.11x. There were no material changes from the proposed to final update of this letter.

Middle-Income Housing

Mortgagee Letter 2025-02 makes similar adjustments to middle-income housing, which HUD generally defines as a minimum of 50% of units restricted as affordable to households earning up to 120% of AMI. The LTC and DSCR for the development and rehabilitation of middle-income housing shift from 85%/1.176x to 90%/1.11x.

The only material change from the proposed to final update relates to minimum use restrictions for middle-income housing. When the draft letter was first issued for comment, it was assumed that a 15-year minimum use restriction period could be required to ensure that middle-income tenants would benefit from the program. During the review period, industry groups provided input that a 10-year minimum use restriction period would be more appropriate, as many existing local and state affordable housing programs operate on terms not exceeding 10 years. As HUD was looking to work harmoniously with programs already in place, the final update includes a minimum use restriction period of 10 years, with optionality for a waiver to approve a term no less than five years.

The update from the two new letters are detailed in the table below.

For more information on how to leverage these changes for your growth plans, contact one of our FHA experts today.

[1] Rent advantage is a 10% discount to market.