The seniors housing and healthcare industry faced diverging trends in 2023. On the positive side, the seniors housing and skilled nursing sectors experienced continued gains in operating fundamentals and occupancy levels. Challenges persist, however, as a disconnect for capital markets participants manifested in 2023 with buyers, sellers, lenders, and investors all struggling to find common ground. How will these dynamics evolve in the coming months? We look at recent market data to shed light on the past year, identify trends, and provide a big picture analysis of what the industry looks like for our 2024 seniors housing and healthcare market outlook.

Seniors Housing Occupancy Moves Higher

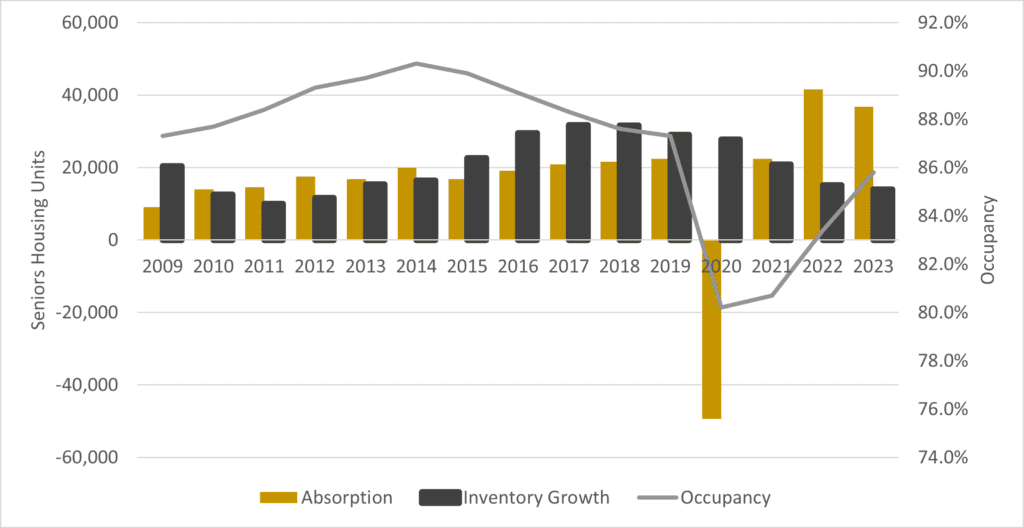

The seniors housing sector continued its run of occupancy gains in 2023. According to NIC MAP Vision, the occupancy rate in primary and secondary markets rose from 83.4% at the end of 2022 to 85.8% in the fourth quarter of 2023 (Figure 1). The occupancy rate was driven higher by strong absorption (the change in occupied units) of just under 38,000 units, reaching striking distance of the pre-pandemic level of 87.3% established in 2019. Given continued trends of lower levels of inventory growth compared to absorption, it is likely the seniors housing occupancy rate will approach pre-pandemic levels as 2024 progresses.

Corroborating NIC MAP’s findings, many notable industry participants reported occupancy gains in 2023, including Brookdale Senior Living, which reported in an 8K filing that its weighted average occupancy rate rose to 78.4% in 4Q23 from 77.1% in 4Q22. Ventas Real Estate Investment Trust (REIT) reported gains within its seniors housing operating portfolio (SHOP) in 2023, noting in its 3Q23 supplemental that its same-store SHOP occupancy across 465 properties rose 110 basis points (bps) from 82.5% in 3Q22 to 83.6% in 3Q23. Same-store cash year-over-year (YOY) net operating income (NOI) growth was 18.2% in 3Q22, according to Ventas. Welltower reported in its 3Q23 supplemental that its SHOP rose 220 bps from 3Q22 to 87.1% in 3Q23. Same-store NOI growth was 26.1%.

Post-Pandemic Challenges Linger

Sonida Senior Living reported improving fundamentals as well during 2023, noting its 3Q23 revenue per occupied room (REVPOR) increased by 11.7% compared to 3Q22. Sonida’s operating margin also improved. Despite the strong performance, Sonida was working to improve its financial condition in 2023, as it entered a forbearance agreement with Fannie Mae for all 37 of its encumbered communities and amended a loan with Ally Bank. Those experiences are evidence of the lingering effects of the COVID-19 pandemic and challenges that have emerged from rising interest rates. While stakeholders are seeing improving top line fundamentals, many are still experiencing cash flow challenges due to higher expenses and increasing debt costs due to higher interest rates.

REVPOR Growth Moves Past Expense Growth

Several publicly traded industry participants reported REVPOR growth in addition to increases in operating expenses during 2023. Welltower reported that same-store REVPOR was up 9.8% YOY while same-store operating expenses were up 5.1%. Ventas reported in its 3Q23 supplemental that same-store REVPOR was 6.2% YOY compared to same-store expense growth of 4.0%. Brookdale reported that same store REVPOR was up 8.9% YOY.

Skilled Nursing Occupancy Climbs

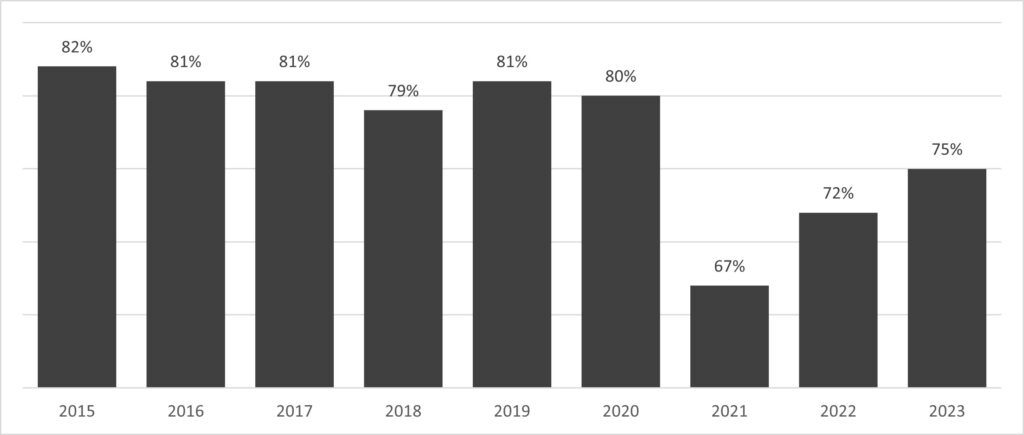

The Certified Nursing Facility Occupancy Rate across the U.S. rose to 75% in July of 2023 compared to 72% the same period one year earlier, according to a KFF analysis (Figure 2). The sector is steadily recovering and will likely approach 80% in 2024 or 2025.

Likewise, notable industry participants reported healthy gains in 2023. The Ensign Group reported in 3Q23 that its same-facility skilled nursing/transitional care nine-month occupancy was 78.9% compared to 75.5% the same period one year earlier. Same-facility revenues also rose 7.8%. National HealthCare Corporation reported its occupancy increased from 83.4% for the nine months ending September 30, 2022 to 87.8% during the same period in 2023.

Skilled Nursing REITs Record Gains

While 2022 was a year of portfolio restructuring for skilled nursing REITS, 2023 was a year of setting the stage for new growth (Figure 3). The largest skilled nursing REIT, Omega Healthcare Investors, reported increasing earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBITDAR) and earnings before interest, taxes, depreciation, amortization, rent, and management fees (EBITDARM) coverage ratios in 2023 after reporting slightly declining ratios in 2022. Sabra Health Care REIT reported its skilled nursing/transitional care segment occupancy increased from 72.9% in June of 2022 to 75.9% in June of 2023. CareTrust REIT said its 3Q23 EBITDAR and EBITDARM coverage ratios have moved ahead of pre-pandemic levels.

| Company | 2022 | 2023 | Change |

| The Ensign Group | $94.38 | $112.21 | 19% |

| CareTrust REIT | $17.58 | $22.38 | 27% |

| National HealthCare Corporation | $57.46 | $92.42 | 61% |

| Omega Healthcare Investors | $25.57 | $30.66 | 20% |

2024 is expecting continued recovery for the skilled nursing sector. Occupancy rates should continue to improve, which should work to offset higher labor costs and rising expenses. The skilled nursing REITs are slowly moving past portfolio issues experienced during and just after the height of the COVID-19 pandemic.

A Dearth of Capital in 2023

Despite improving fundamentals for seniors housing and skilled nursing stakeholders, a decreasing flow of capital was prevalent in 2023. Many banks and lenders were less active in 2023 compared to previous years. This, in turn, affected investment volumes and capitalization rates across the sector. Fannie Mae and the U.S. Department of Housing and Urban Development/Federal Housing Administrations (HUD/FHA), two of the largest and most consistent sources of capital to the sector, saw decreased volumes in 2023. Fannie’s seniors housing delinquency rate (60+ days) also increased to 9.97% in 3Q23 from 0.48% in 3Q22. The HUD/FHA Section 232 program also saw decreased production in 2023, with 186 loans in fiscal year (FY) 2023 compared to 279 loans in FY 2022.

Likewise, many lenders and investors saw decreased volumes in the past year. The 10-year Treasury rate, which moved higher during the first three quarters of 2023, peaked near 5% in October before falling back to 4% to end 2023. In addition, the M2 money supply, which is a barometer of investible assets in the U.S., declined by $700 billion in the first half of 2023, according to the Federal Reserve. It stabilized near current levels in the second half of 2023.

REITs also saw lower investment volumes in 2023. Welltower reported a nine-month gross investment volume in 2023 of $2.83 billion, which was down 23% from 2022’s volume of $3.67 billion during the same period (Figure 4). Ventas followed a similar path, however both CareTrust and Omega Healthcare reported increasing volumes as compared to 2022. The REITs also reported increasing yields on investments. Welltower stated its initial yield on investments had moved from 5.7% in 2022 to 6.9% as of 3Q23. CareTrust reported its first yield on investments moved from 9.0% in 2022 to 9.8% in 2023.

| Company | 2022 | 2023 | Change |

| Welltower | $3.67B | $2.83B | -23% |

| Ventas Realty Trust | $1.17B | $0.28B | -76% |

| CareTrust REIT | $0.17B | $0.24B | 45% |

| Omega Health Investors | $0.15B | $0.17B | 14% |

| Totals | $5.16B | $3.51B | -32% |

These capital market trends were prevalent not only in the seniors housing and skilled nursing sectors but across most of commercial real estate in 2023. There was a gap in pricing expectations between buyers and sellers and rate uncertainty that slowed growth. However, towards the end of the year we were beginning to see faint signs of a new normal settling in. Interest rates have begun to stabilize, and industry participants should increasingly be noticing that the bid-ask gap is beginning to close. Investment volumes will take time to get back to normalized levels, but 2024 should bring slightly brighter days for capital markets participants.

We will be sure to stay on top of emerging trends in 2024 and, as always, will leverage our insights to help you take advantage of market opportunities and navigate around potential risks. For more information on how to succeed in 2024, contact a Lument expert today.