In 2022, the seniors housing and healthcare sector made up some of the ground lost to the pandemic, as rising occupancy rates and improving fundamentals helped operators accelerate their post-COVID turnarounds. At the same time, 2022 was not without its challenges for seniors housing and skilled nursing stakeholders, as financial support provided by the federal government began to slow, rising interest rates in the second half of the year made capital more difficult to secure, and several large owners underwent major portfolio restructurings

After such an eventful year, where does the market go from here? In this article, we offer our attempt at an answer as we examine recent market data to shed light on the past 12 months, identify trends, and provide a big picture analysis of what the industry looks like as 2023 unfolds.

Seniors Housing Occupancy Gains Accelerate

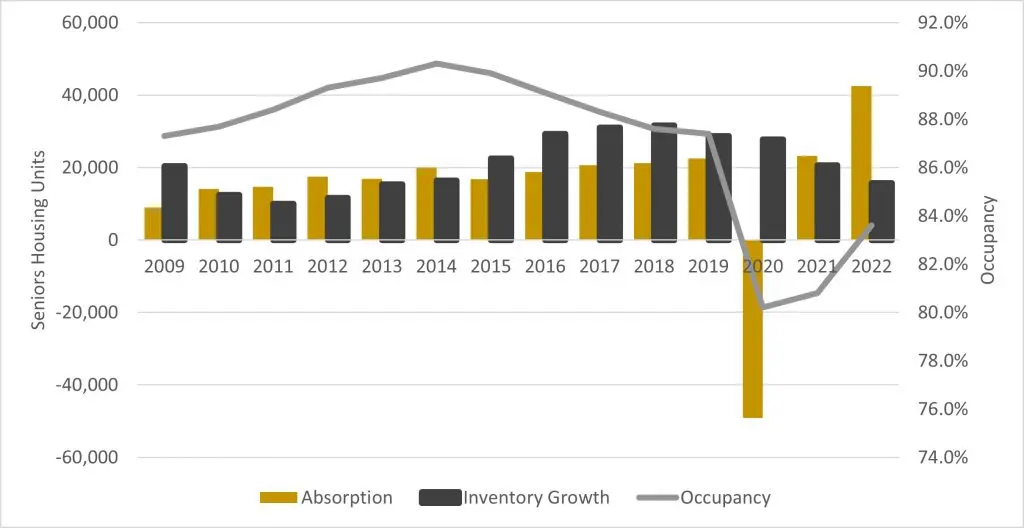

The seniors housing sector registered significant occupancy gains in 2022. According to the NIC MAP Vision platform from the National Investment Center for Seniors Housing & Care (NIC), the occupancy rate within NIC MAP’s primary and secondary markets, rose from 80.8 percent at the end of 2021 to 83.6 percent in the fourth quarter of 2022 (Figure 1). The occupancy rate was buoyed by record absorption (the change in occupied units) of over 42,000 units in 2022. Though still well below the 90.3 percent level observed in 2014, the 270 basis points (bps) increase and 42,000 units of absorption mean the sector has a full recovery of occupancy in its sights.

(source: NIC MAP Vision)

Industry participants also reported occupancy gains in 2022. Brookdale Senior Living reported in an 8K filing that its weighted average occupancy rate rose to 77.0 percent in December 2022 from 73.6 percent in December 2021. Welltower reported in its 3Q22 Supplemental that its senior housing operating total portfolio (SHOP) occupancy has risen from 74.9 percent in 3Q21 to 78.0 percent in 3Q22. These occupancy gains led to 17.6 percent year-over-year (YOY) same-store net operating income (NOI) growth, according to Welltower. Ventas REIT also reported occupancy gains in 2022, reporting in its 3Q22 Supplemental that its same-store SHOP occupancy rose 260 bps from 82.1 percent in 3Q21 to 84.7 percent in 3Q22. Same-store cash YOY NOI growth was 13.0 percent in 3Q22, according to Ventas.

As we head into 2023 there are many economic uncertainties for operators and investors to consider. The ability of seniors to sell their homes affects demand for independent living and retirement living. Although very market specific, Zillow is reporting house price declines on a month-to-month basis in its December 2022 Market Report. Investment portfolios, which speak to affordability of private pay seniors housing, also fell in value in 2022. Investors should monitor these trends as they evaluate demand and affordability. Despite the uncertainty, the age wave is gathering force, and investors should expect occupancy gains to continue into 2023, which will be welcome news to the seniors housing market.

Average Monthly Rent and REVPOR Accelerate in 2022

Average monthly rent (AMR), YOY rent growth and revenue per occupied room (REVPOR) growth all accelerated in 2022. AMR was $4,635 per unit/month in 4Q22, according to NIC MAP Vision. This was up from $4,386 in 4Q21. In addition, YOY rent growth was 4.9 percent in 4Q22, according to the platform. Several publicly traded industry participants report REVPOR and REVPOR growth. Welltower reported in its 3Q22 supplemental that same-store REVPOR was up 5.4 percent YOY. Ventas reported in its 3Q22 supplemental that same-store REVPOR was 5.4 percent YOY. Brookdale reported in its 3Q22 supplemental that REVPOR was up 4.1 percent YOY.

Pricing power for seniors housing operators was evident in 2022. Continuing improving occupancy rates as well as continuing inflationary pressures should mean YOY rent growth and REVPOR growth increase at above historical levels in 2023.

Occupancy Rising Across the Skilled Nursing Sector

Occupancy rates continued their ascent within the skilled nursing facility (SNF) segment in 2022. Data from the American Healthcare Association/National Center for Assisted Living shows the average occupancy rate among 13,878 SNFs in the U.S. was 75.3 percent as of January 1, 2023. This figure was up from 72.3 percent one year ago. While increasing 310 bps, the occupancy rate is still lower than its occupancy rate of 80.2 percent at the end of 2019.

Publicly reporting SNF companies also reported occupancy gains in 2022. The Ensign Group reported in its 3Q22 form 10Q that its occupancy went from 74.4 percent in 3Q21 to 76.8 percent in 3Q22. Sabra Healthcare REIT reported 3Q22 occupancy of 72.9 percent compared to 3Q21 occupancy of 71.1 percent. Omega Health Investors and Promedica Health System also reported 3Q22 occupancy increases.

Portfolio Restructuring More Prevalent in 2022

The federal and state governments provided assistance to many seniors housing and SNF operators during the Covid-19 pandemic. The 2020 CARES Act as well as other federal and state-based relief funds were important financial buoys to operators during this time. But as the pandemic has eased, so has the funding to operators. As a result, several larger owners and operators have reported varying levels of stress and/or restructuring in 2022. Omega reported in an 8K filing on January 9, 2023 that relief funding has slowed to operators and that less than ten percent of its operators had stopped paying rent as of September 2022. Omega is initiating rent and portfolio restructuring with several of its operators. Welltower announced in November agreements to effectuate the sale and transition of 147 SNFs currently operated by ProMedica and transition these assets to Integra Health. National Health Investors and Sabra also reported various portfolio restructurings in 2022. Expect restructurings to continue into 2023, although a healthier operating environment should also emerge as the year progresses.

Capital Markets Disruption in 2022

Investors and lenders were looking forward to a robust continuation of transaction activity in 2022. For the most part that is the way the year started. Investors on the seniors housing side were focused on growing NOI streams while SNF investors were largely looking for good turnaround and growth opportunities. The REITs were active through the third quarter of 2022. Welltower reported it has completed $3.7 billion of gross investments year-to-date (YTD) through 3Q22 compared to $4.1 billion YTD through 3Q21. Ventas reported it had YTD investments of $1.2 billion through 3Q22 compared to $3.5 billion in 3Q21.

Investment volumes, however, were affected by macroeconomic disruptions in 2022. Inflation entered the U.S. economy with the CPI rising throughout the year and finishing at 6.5 percent in December. That caused the Federal Reserve to hike its benchmark Fed Funds rate seven times in 2022, rising from essentially zero percent to start the year and ending the year in the target range of 4.25 to 4.5 percent. This caused an inverted yield curve to take shape in the second half of 2022. The 10-year treasury yield has been trending underneath shorter-term instruments such as the two-year treasury. This yield curve inversion deepened throughout 2022 and the 10-year sat roughly 53 basis points underneath the two-year at the end of 2022 (Figure 2).

Further, the 10-year Treasury rose to 3.5 percent at the end of 2022, causing loan rates to adjust upwards which has impacted the price buyers are willing to pay for assets. Retrades, where the buyer asks for a lower price well into the process, have been prevalent in the second half of 2022 within the commercial real estate sector. This resulted in a period of price discovery and while the private market may not yet be representative of lower asset values, the public markets are. The movement in the implied cap rates of the Healthcare REITs show that asset values have declined in 2022 and that cap rates are moving up. In fact, an analysis of Welltower, Ventas and Caretrust REIT shows their collective enterprise value has fallen by 13 percent from the end of 2021 to September of 2022. In addition, their weighted average implied cap rate has risen approximately 90 bps during this period.

Perhaps the biggest question for investors heading into 2023 is will cap rates increase at rates the public markets are suggesting? Or will public market valuations rise to merry back up with the private market? Either way, one can reasonably expect a choppy start to the 2023 transactions market until there is more clarity on this issue.

We will be sure to stay on top of emerging trends throughout 2023 and keep you informed. Please contact us today to discuss how we can help you take advantage of market opportunities and navigate around potential risks.